Meet Penfold: The flexible pension for the self-employed

We talk to Penfold’s Co-Founder, Pete Hykin, about why self-employed folks need a pension and how whatever they save now, big or small, will reap benefits in the future!

When you’re self-employed, or working as a freelancer, there’re SO MANY things you need to think about - lots of hats to wear, balls to juggle etc - whatever analogy you choose, the struggle is real! In amongst finding new clients, creating your website, networking, filing your tax returns, actually doing your day job and trying to live your life, pensions are often a neglected part of the ‘to-do’ list…if on the list at all!

As my husband is a finance-geek he made sure me and Jess got our pensions sorted pretty early on as we formed The Doers and if we can pass on one piece of financial advice to anyone self-employed - newbie or long-timer - it would be to think about your future, plan for it and start a pension today!

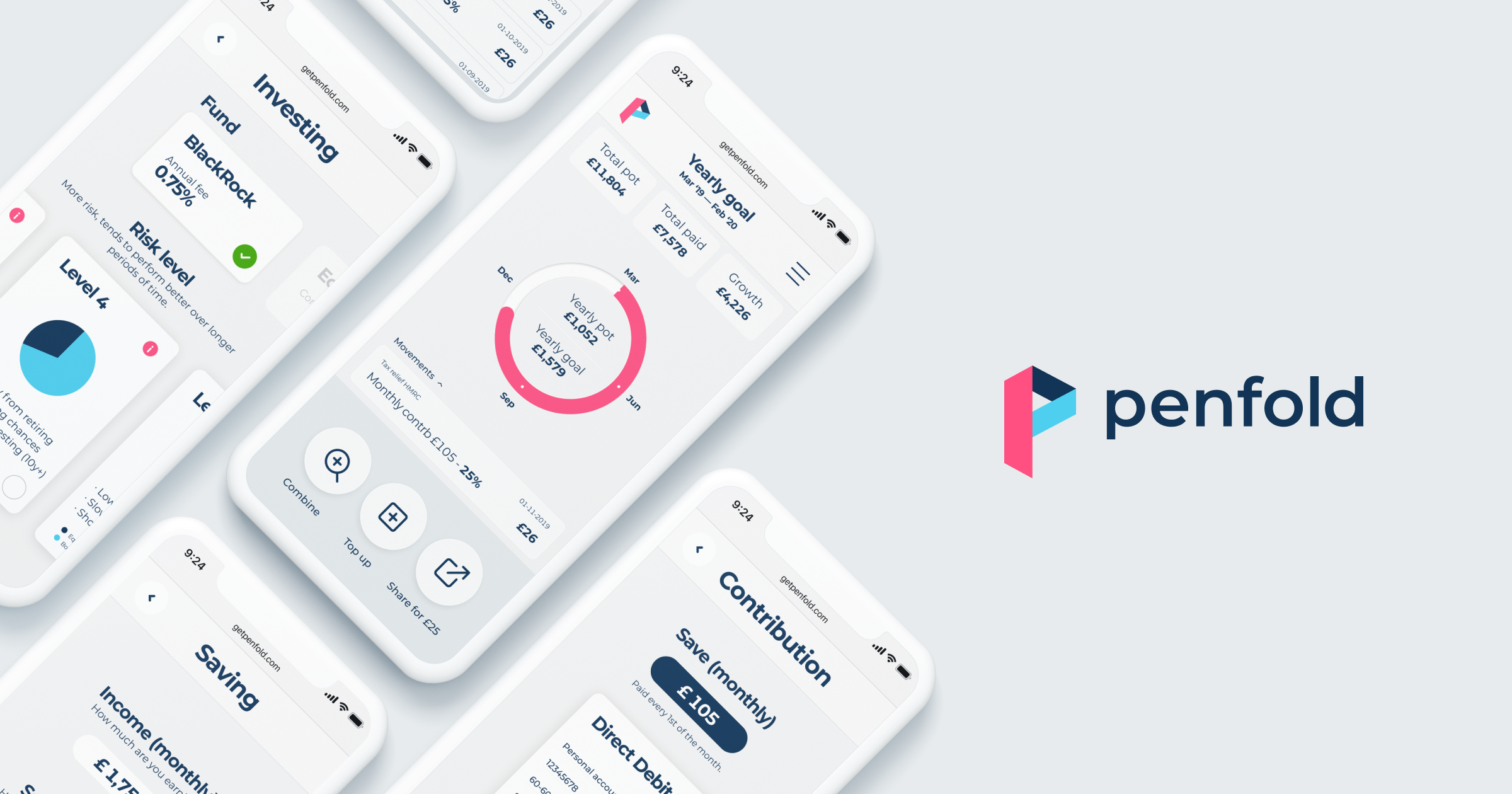

We discovered Penfold via Twitter some time in late summer of 2019 and spotting the words ‘pension for the self-employed’, immediately pricked our ears up. A relatively new fintech start-up, Penfold really know their stuff but most importantly, they understand the mindset of the self-employed. They’ve made their service as simple and pain free as possible - it takes just five minutes to set up an account - and they explain everything in a universal language. Their handy online pension calculator lets you work out how much you should be saving each month and what your future could look like. They’ve made paying into your pension entirely flexible, allowing you to reduce payments in slower months and top up in busier ones. Their team are bloody delightful and genuinely want nothing more than to help you save for your future and make sure you understand everything clearly - they’ll even move all of your old pensions pots over for you - it took Jess just 5 seconds to do that!

We caught up with one of Penfold’s Co-Founders, Pete Hykin to find out more about Penfold. From why he created a pension with the self-employed in mind to how using technology and a genuine human touch has allowed them to disrupt the pension sector and create a pension that does what it’s supposed to without all the jargon, pain and confusion.

Welcome to The To Do List! Tell us a little bit about yourself…

Hello! I’m Pete, I’m 29 years old and the co-founder of Penfold. I did a stint in finance (at Deloitte) and have spent the last few years helping to build two under the radar but pretty cool, successful technology companies. I spent a bit of this time freelancing (under my own Ltd company) and the general theme of all these businesses was “the changing nature of work”.

Where did the idea for Penfold first come from?

I had a really generous pension when I worked in finance, but as a freelancer after that, I had nothing. One summer I tried 5 different times to open a personal pension (and I’m fairly savvy with these things) and failed because it was so painful. I kept getting told I had to call the provider, or schedule a call with an advisor, or print something off, or deposit huge minimums (£000’s!) that I didn’t have. It made me so mad and I knew something better was possible.

What steps of creating and growing a start-up have surprised you the most? What parts have you enjoyed and which parts have been difficult?

Surprising: How many people are willing to help and support you & share their advice, contacts or skills.

Enjoyed the most: Pensions isn’t a super emotional topic, but before we even launched Penfold, I spoke to hundreds of people about their pensions. Occasionally I’d meet or talk to someone who was quite frankly being treated like garbage by the industry. This was happening to people who were trying to save very small amounts, but the enormous fixed fees were eating into their savings when they were just trying to do the right thing and put *something* aside for their future. I also found so many people were being ground down by the insane hoops they had to jump through to transfer their pension away from some archaic provider, or basically being told their business wasn’t worth the pension providers time, getting no help or support or having any of their perfectly reasonable questions answered.

Since launching Penfold, the best part has absolutely been going back and finding those people and showing them a pension provider that actually cares about them and (at least tries) to get more of that stuff right.

How did you go about raising the funds you needed?

Me and my co-founder, Chris, both worked for a couple of months without a salary. We were very lucky that we had savings from our previous jobs, neither of us had kids at the time, and both had very supportive (and patient) partners!

The first money we raised came from people that we’d worked with before (or had invested in companies we’d helped build previously). Although one cheque from one of our favourite investors did come from a cold message I sent on LinkedIn – so that works too!

Why is setting up a pension when you’re self-employed so important?

Because unless you have a pension, you’re going to have to keep working until you die.

That almost sounds flippant but it’s really not funny, and it’s really not realistic either.

The government will pay you a small state pension when you’re about 68, but most people agree that’s pretty old, and not enough to live on anyway.

You need a pension of your own, and you need to be paying in to it from the day you start working. That includes the years you’re self-employed. I really don’t think you can afford the gap; your future is too important.

What are the main obstacles to the self-employed setting up a pension?

As with everything, being self-employed means you’re pretty much on your own. Which means no HR or payroll department setting up a pension for you and holding your hand through the process. I think there are three key obstacles:

Not knowing where to start: What is a pension? What should I even be googling here? Private pension? Personal pension? Stakeholder pension?

Bamboozling pension websites: Hundreds of different options and scary decisions to make (where should I invest my money? How much does this cost? Why are there so many warnings about risk?)

Knowing how much to save each month: Specifically for the self-employed, having the flexibility to change it when your invoices don’t get paid, you have a bad or really good month.

We’ve made it our mission at Penfold to tackle most of these.

How have you been able to make the process and understanding around pensions so quick and simple?

We make pensions understandable by doing one very simple thing. We listen to our customers. We spoke to – literally – hundreds of self-employed people before we even started writing code or talking to investment managers. And we keep talking to them. We run workshops, we watch them use Penfold, we talk to people who’ve never heard of us. Each conversation helps us understand their perspective a little more, make something a little clearer, strip out another confusing word, re-structure a scary step in the setup process. It’s an ongoing thing but we’re pretty confident we’re already the simplest pension in the world to set up.

Self-employed income can fluctuate from month to month. How much do you recommend the self-employed put into their pensions each month?

A good rule of thumb for how much to save is to take the age that you started saving into a pension, and divide it by 2. That number is the percentage of your income you should pay into your pension. (i.e I started saving at age 20, divide 20 by 2 and I get 10, so I pay in 10% of my income).

The great thing with Penfold is that we’re flexible and it’s super easy to pause or change your contributions anytime. A lot of our customers set a monthly contribution that might be quite small, but that they “know” they can afford each month. They then top it up at the end of the year once they know what they’ve earned to get to their 10%.

How does your online calculator work?

We look at what you earn now, and suggest how much you’d need to “earn” when you stopped working (perhaps when you’ve paid off a mortgage or your kids have moved out and your expenses are down).

We then figure out how much you need to have saved up in order to earn that much in investment income each year.

From here we figure out how much you’d need to save every year between now and when you retire, to have your target total saved. We take into account some growth in the stock market, tax benefits, inflation, and potential pay rises!

During the Coronavirus crisis you decided to cut your Penfold fee to 0% for six months - longer if you can. How did you come to making this decision and what does it mean to Penfold customers?

We’re very lucky – our jobs at Penfold are secure. We saw so quickly the devastation Coronavirus and the lockdown caused for our customers and that this wasn’t true for them, so felt we had to do *something*. We knew that this wouldn’t put any actual extra cash in our customers pockets, but we hoped that this small gesture would help them all to keep on track with saving for their futures even through uncertain times.

We also think that the markets will recover. By reducing our fees now, we’re making sure you have more money in your pension pot to help you benefit from the market rebound.

You’ve chosen to work with BlackRock as your pension investment partner - why them?

More than anything, we chose BlackRock because they are one of the world’s largest money managers and they have a reputation for keeping money safe and managing it well. We met a team from BlackRock very early on, and ever since they’ve been incredibly supportive.

What are your plans and hopes for the future of Penfold...what’s next?

We’re building the best pension in the world, for everybody. In the long term I don’t think it will matter what type of work you do – you’ll just need a good pension, for you, for life. That’s what we want to create

Give us your top 3 recommendations

I don’t really listen to podcasts, but for building companies, I think it’s summed up in “Do things that Don’t scale” by Paul Graham, although I recommend reading everything he’s ever written.

“Lean in” by Sheryl Sandberg was probably the most eye-opening business book I ever read, and think everyone should try and finish “Happy” by Derren Brown.

What were you doing this time last year? What have you learnt or how have you changed since then?

We were a team of 4, desperately trying to get the Penfold test site live, and I was focusing on finding our first 200 testers. The biggest learning since then is definitely that “Yes, people actually need Penfold”. Thousands of self-employed people are now saving with Penfold, and a year ago I really didn’t know if anybody wanted or needed us.

To open a pension with Penfold, calculate your monthly payments or to move all of your existing pensions into a Penfold pot just visit their website - the sign-up process is super simple and their team are friendly, helpful and make the whole thing a breeze. You’ll thank yourself later.

We even have a special Doers offer for you - use this link or the reference code ‘thedoers’ and Penfold will put £25 straight into your pension pot for you when you open an account - wonderful stuff!